Brief Instructions

At the beginning of the game, each student receives some amount of cash and a number of shares in a company. At the end of each round, each share pays a dividend (either high or low, each with 50% chance) whereas interest is paid on cash. Each possible dividend is equally likely. During each round, students participate in a double auction to buy or sell the shares. Students will see their own transactions appear as black dots with the transactions of others appearing as white dots on the game screen.

We set the default parameters so that a) the asset's expected and maximal payoffs are easily calculable; and b) the default parameters are conducive to bubble formation.

By default, dividends of $1.00 and $0.40 each occur with 50% chance, there is no interest on cash, and the asset has no terminal value. This means that the asset's maximal payoff is $1 times the number of dividends remaining, $10 in the first of 10 periods. Expected payoff (and thus, the fundamental value, assuming risk neutrality) is $0.70 times the number of remaining dividends, $7 in the first of 10 periods. Transaction prices above the asset's maximal payoff are consistent with a speculative asset bubble.

Experienced players are less likely to form a speculative asset bubble. On the other hand, increasing starting cash balances seems to facilitate bubble formation.

Key Treatment Variations

Inducing a flat fundamental value is a great way to combine this game with a lesson on asset pricing. With a positive interest rate, you get a constant fundamental value across periods by setting the terminal value equal to the present value of the infinite stream of expected dividends (i.e. the expected dividend by the interest rate on cash). With the default dividends ($1.00 and $0.40 each with 50% probability), setting a 10% interest rate and a $7 terminal value results in a $7 fundamental value in all periods.

In this context, you can increase the likelihood of a bubble by simultaneously increasing both the interest rate and the dividends. For example, doubling both the expected dividend and the interest rate does not affect the asset's fundamental value, but does appear to increase the likelihood of speculative bubbles.

In the case that you want to add your own configurations on the configuration page, note that the y-axis scale reaches only to twice the maximum stock value, so any higher values will not be shown in the results section. When adding dividends to the dividend field on the configuration page, know that you can add more than two dividends within the parameter configuration.

Results

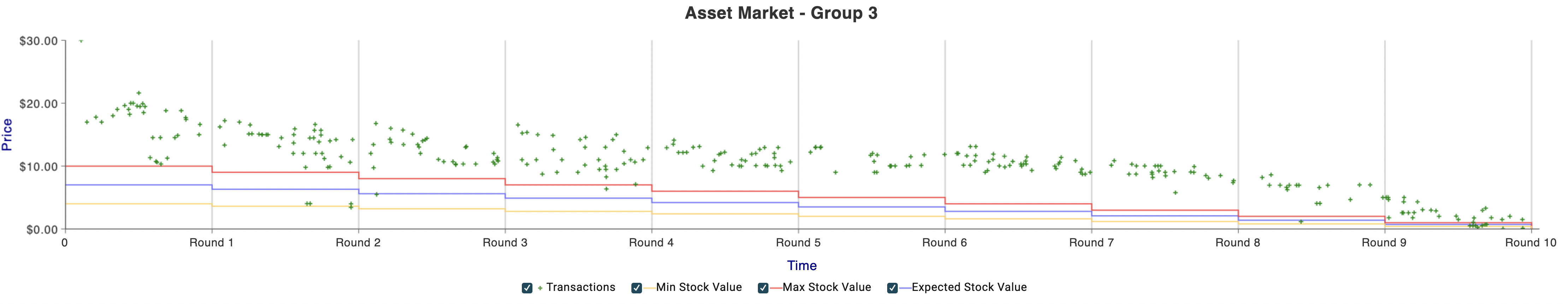

An asset purchase at a price above the discounted value of the higher dividend in all rounds (plus the discounted terminal value) is consistent with speculative demand. A string of such purchases is evidence of a speculative asset bubble.

The main graph (Figure 1) makes it easy to identify a speculative bubble. Each transaction's price is depicted in the graph, as are three additional benchmarks. The blue line shows the asset's expected value if held to the final round. Absent speculative demand, this would be the price with risk neutral investors. The red line is asset's payoff if the higher dividend is realized each period. The yellow line is asset's payoff if the lower dividend is realized each period. While transactions between the blue and red lines can be explained by risk-loving preference and transactions between the blue and yellow lines can be explained by risk-averse preferences, prices above the asset's maximal payoff can only be justified by a belief of later resale at a price above the asset's maximal payoff (i.e., speculative demand).

Note that when a speculative bubble crashes, transaction prices often dip below the asset's expected fundamental value.

Robot Play

Our robot (i.e., an automated player) will randomly post an offer or ask (50% chance for either) with a randomly drawn bid between 1 to 4 times the expected value of the stock. Due to this logic, you will experience a regression to mean as the expected stock value decreases from round to round.