Results

The results will help you highlight the pull of marginal-cost pricing in Bertrand markets

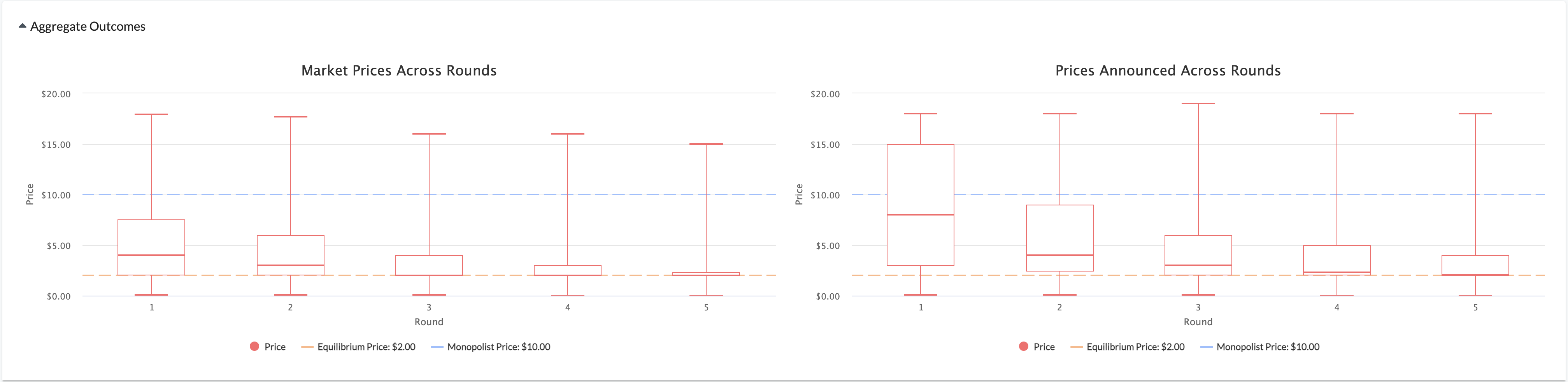

The first set of graphs (Figure 1) show the by round evolution of prices across all groups. In each graph, a box-and-whiskers plot is displayed for each round. (The boxes span the 25th and 75th quartiles, with a line indicating the median. The whiskers extend to the the extreme values.) Market Prices Across Rounds include only those prices resulting in sales, whereas Prices Announced Across Rounds includes all announced prices (whether or not any were sold at that price).

The next set of results (Figure 2) allow you to focus on particular groups. The Group Summary Table displays, for each group, average and final-round surpluses. Marginal cost pricing results in 100% efficiency (i.e., total surplus maximized), and thus a quickly converging group registers average efficiency (across all rounds) closer to 100%.

To dig more deeply into the prices announced by a particular group, click the radio button next to the Group Number in the table. The resulting graph will indicate the choice of each student in each round.

Note that you can select which elements to include in the graph by clicking the checkboxes next to the label in the legend.