19

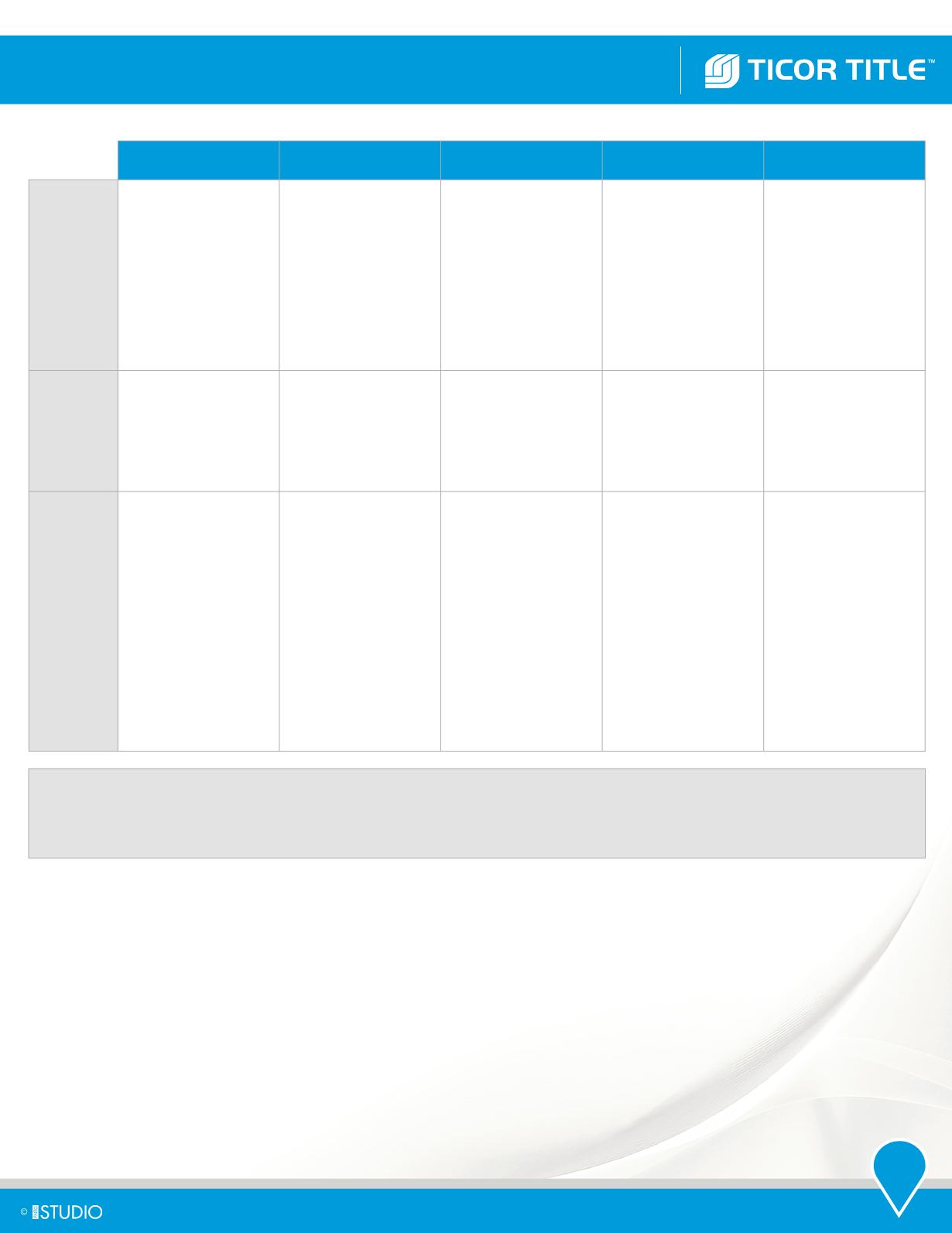

VESTING: COMMON WAYS OF HOLDING TITLE

Community

Property

Joint

Tenancy

Tenancy in

Common

Tenancy in

Partnership

Title Holding

Trust

Death

On co-owner’s death,

1/2 belongs to survivor in

severalty. 1/2 goes by will

to decedent’s devisee or

by succession to survivor

On co-owner’s death,

his/her interest ends and

cannot be disposed of by

will. Survivor owns the

property by survivorship

On co-owner’s

death, his/her

interest passes

by will to devisee

or heirs. No

survivorship rights

On partner’s death, his/

her partnership

interest passes

to the surviving

partner pending

liquidation of

the partnership.

Share of deceased

partner then goes

to his/her estate

Successor

beneficiaries may

be named in the

trust agreement,

eliminating the

need for probate

Successor’s

Status

If passing by will,

tenancy in common

between devisee

and survivor results

Last survivor owns

property

Devisee or heirs

become tenants in

common

Heirs or devisees

have rights in

partnership interest but

not specific property

Defined by the

trust agreement,

generally the

successor becomes the

beneficiary and the trust

continues

Creditor’s

Rights

Property of the

community is liable for

debts of either spouse,

which are made before or

after marriage.

Whole property

may be sold on

execution sale to

satisfy creditor

Co-owner’s interest may

be sold on execution sale

to satisfy his/her creditor.

Joint

tenancy is broken.

Creditor becomes a

tenant in common

Co-owner’s interest may

be sold on execution sale

to satisfy his/her creditor.

Creditor becomes a

tenant

in common

Partner’s interest

may be sold

separately by

“Charging Order”

by his/her personal

creditor, or his/her share

of profits may

be obtained by a

personal creditor.

Whole property

may be sold on

execution sale to

satisfy partnership

creditor

Creditor may

seek an order for

execution sale

of the beneficial

interest or may

seek an order that the

trust estate be liquidated

and

the proceeds

distributed

Ticor Title has provided these comparisons for informational purposes only. These charts are not to be used to determine how

you should acquire ownership in the property. It is strongly recommended that you seek professional advice from an attorney

and/or your tax advisor to determine the legal and tax consequences of how your title should be vested.